What you’ll learn in this blog

- High level description of estimating remediation portfolio liabilities

- Four characteristics of software that supports remediation business requirements you should be looking for

- A deeper look into one of the features and examples of how that is manifested in ENFOS

Is it possible that you could find yourself in this situation when the CFO calls you on Friday afternoon…?

Picture this,

“Michael, I’d like to see the portfolio financials on our Hawthorne Remediation Project up to date by Monday. We’re having a board meeting Tuesday and I’d like to go over the spend with you once I’ve looked at the data. Fourth quarter is just around the corner, you know!”

“OH NO! The agreed-upon scope changes over the last 3 quarters from the consultant are in the my email inbox still. Did I download all of those spreadsheets or leave them attached to the emails. WE had a scope change on pipe quantities and labor hours because we found an extra area that needed more soil vapor work. Oh, Geesh, where’d I put those files? I know I put them somewhere; files I have reviewed are usually in this folder but where are my reply emails with approvals…and what about that unexpected subcontractor quote. I have a lot of work to catch up on before Monday!”

“If only I’d said “yes” to that demonstration by ENFOS when they were here. That sure looked like the ticket to what I needed for keeping my project- spend up to date, organized, and ready on-demand! What am I going to do?”

Here’s what you can do! In this blog post, we’re going to cover the following:

In the remediation industry, portfolio performance, spend management and even forecasting efficiency are affected by where and how you manage and store your data. Do you keep it in files shoved in a variety of colored folders on your desk or in excel spreadsheets that are cumbersome and out of date because of multiple versions? Does it feel like tax-time when you are requested to present your next performance review? Let’s make this easier for you!

3 Financial Models for Estimating Environmental Liabilities – High Level Description

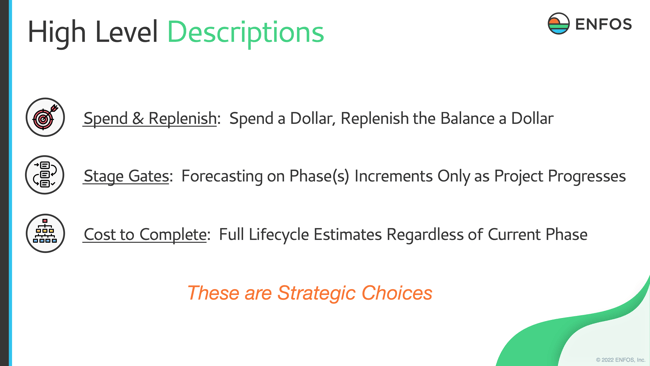

There are generally three practices for estimating environmental liabilities and even hybrids arise in situations on some portfolios. The three you will be briefed about here are the “Spend-and-Replenish Approach”, a “Stage-Gate (or a milestone-based) Approach”, and then a “Cost-to-Complete Approach”. See Figure 1.

The “Spend and Replenish Approach” means that as we're spending money on a project during a period (like a quarter or annually), we're putting money back into the balance for the next period, dollar-for-dollar. Spend and Replenish can refer to a project or an entire program. The overall budget ends up being a flat line through time.

The “Stage Gate Approach” is where we’re forecasting step-by-step, in phases or in small groups of combined phases (e.g., site characterization and feasibility study). As the project progresses, usually around major milestones, the project is moving into a more stable and predictable phases, such as long-term monitoring.

The “Cost to Complete Approach” is where our customers in the industry will use full life cycle estimating regardless which phase their project is in, i.e., from the beginning or very early on in the life of a new remediation project. Similar historical projects are often used as the basis for the estimate.

Shared Foundational Business Requirements & Software Characteristics

Companies that have sites located in more than one geographic location are most likely required to perform their financial liability estimating in the same fashion whether they reside in the Netherlands or in the United States. Company policies are generally based on US GAAP or IFRS requirements, and there are differences. Supporting business models have been developed to guide the management of their data in an organizational structure that helps support planning, forecasting, disclosure, and reporting.

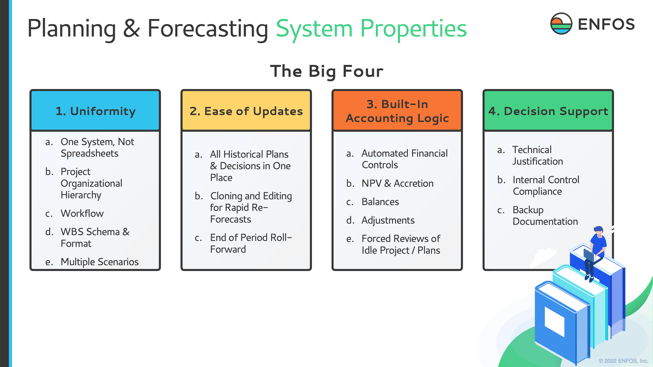

Common Characteristics of business system models include what we are describing in Figure 2 as the “Big Four”, uniformity of executing the model, ease of updating the model, built-in accounting logic, and decision support. A brief description of these goes like this:

- Uniformity in executing the model includes project organizational structure, workflow requirements, work-breakdown-structure schema, and format within multiple scenarios.

- Ease of updates is required to keep up with historical plans and decisions and maintaining them in one place, keeping up with editing and cloning for rapid forecasting, and automated adjustments based on end-of-period roll-forward.

- Built-in accounting logic covers a lot of financial aspects, such as automated financial controls, Net present value and accretion, balance calculations, adjustments, and forced reviews of idle projects or plans.

- Decision support has to be consistent also regarding technical justification, internal control compliance, and backup documentation.

Let’s drill down on one of the features.

The Uniform Work Breakdown Structure

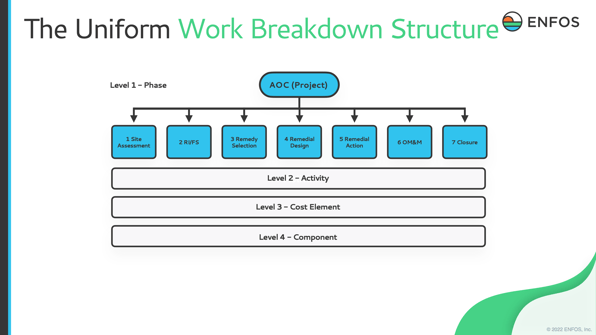

First, we’ll take a look at what kind of information a project manager needs to keep organized right at the basic level. The work-breakdown structure (WBS) can be used across one or many areas of concerns (AOCs) for a client.

No matter which estimating approach you use, e.g., Cost-to-Complete or Stage Gate, the most detail is on the spend. Each WBS can be set up to track cost-accounting categories like labor, materials subcontractors, equipment. And, the WBS elements can be set up for each phase, such as in Figure 3, for Site Assessments, Remedial Investigations, etc.

How WBS is Manifested in ENFOS - Example Financial Plan

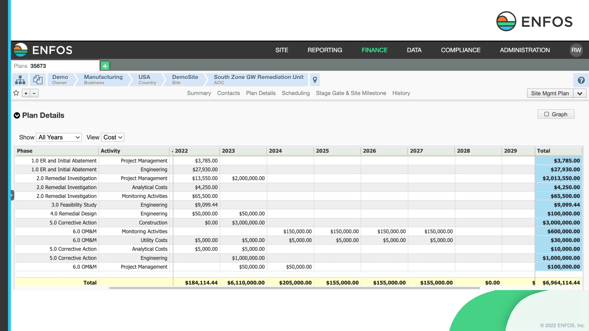

When working with ENFOS, you have a great number of options in your selection of configurability for the layout of the WBS. Everything is organized by WBS, so you see how important it is to be consistent across the board. See Figure 4.

For every phase of the project set up with a WBS (e.g., RI/FS to OM&M), ENFOS tracks plan spend, balance, commitment, and purchase order balances for you. It’s a lot easier than an Excel spreadsheet and a pile of colored folders! ENFOS also gives you the option to view monthly, quarterly, or annual forecasts, depending on the estimating approach you’re running.

When changes to the plan are made, reasons for the financial adjustments within the Cost-to-Complete can be tracked by ENFOS. You may ask why that’s so important…perhaps a regulator doesn’t approve a remedial plan implementation and you need to push off spend for another year. That has to be reflected in the forecast! You don’t want to be looking for the “red regulator folder” on your desk…all these changes will be available, accurate, and on-demand when they are in ENFOS!

Summary

When an organization has built-in software at its fingertips to inform managing remediation environmental liabilities, it more accurately defines the current spend, minimizes errors, and standardizes the reporting format for the project manager, the project team, Remediation Director, and CFO!

But, when there is so much data to collect and maintain for forecasting, budgeting, approving work authorizations and adjusting changes to scopes of work, it becomes much simpler if you get down to the original budget and start from there. Set up a work-breakdown structure that makes sense for your organization that will meet the needs of your project team. ENFOS can help centralize the management of your data and ready the deliverables when you need them.

Are you interested in accessing ENFOS for your data management? Schedule a chat with our product experts here.